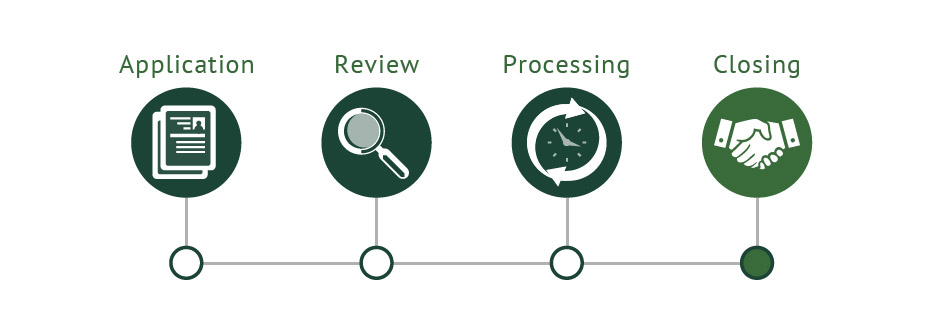

Application

There are a number of important steps involved in making the dream of homeownership a reality, and one of them is completing your Uniform Residential Loan Application. The mortgage loan application includes several sections that capture information about you and your finances as well as the details of your potential mortgage. It's lengthy and at first glance seems complicated, but your loan officer will be able to help assist you with this step. It is very important that you are able to answer the questions as accurately as possible to assure reliable information for the next step. Along with the application, you will also be asked to submit the following documents:

- (2) Forms of ID, one of which is a photo ID

- Current income verification (Choose from the following)

- Tax return

- Current paystubs

- SSI awards letter

- W-2

- Copy of divorce decree or separation papers and parent plan, if applicable

- Copy of homeowners insurance policy, if refinancing

- Purchase contract, if applicable

- Copy of deed

- Copy of survey

- Current mortgage information, if refinancing from another financial institution

Review

Once your application is complete, your loan officer will review it and ask you to sign it. He/she will then run it through our approval process, which includes scoring and grading based on your Debt to Income, Credit Score, Collateral, Stability, and Capital. All factors are seriously considered in approving a mortgage loan, and are calculated using the figures and information provided on the Uniform Residential Loan Application.

If an application is not approved, the officer may contact you with a counter offer, or will list in detail the reasons for the denied loan application.

If your application is approved, you will move on to the next step.

This phase usually takes 3 days to complete!

Processing

After your loan has been approved, and within three days of your application, we will provide you with a variety of documents outlining the costs associated with your loan. These forms will provide you with an estimate of your mortgage loan terms and settlement charges. Using this information, you can evaluate your mortgage loan before accepting it.

If you agree to the terms listed on the disclosures, you will need to advise us of your intent to proceed with the process. Once we have received the green light, we will begin the appraisal, title search and document preparation stage, which can last anywhere from two to three weeks depending on the property involved. After reviewing and approving the appraisal and title search, we will move onto the final step of the process.

Closing

A closing is a meeting that involves all of the parties signing the final documents and legally transferring the property to you. This is the time when your loan agreement and mortgage or deed of trust are signed along with several other disclosures, affidavits and declarations. When you are finished signing all of the closing documents, your mortgage process is complete and you are officially a homeowner!